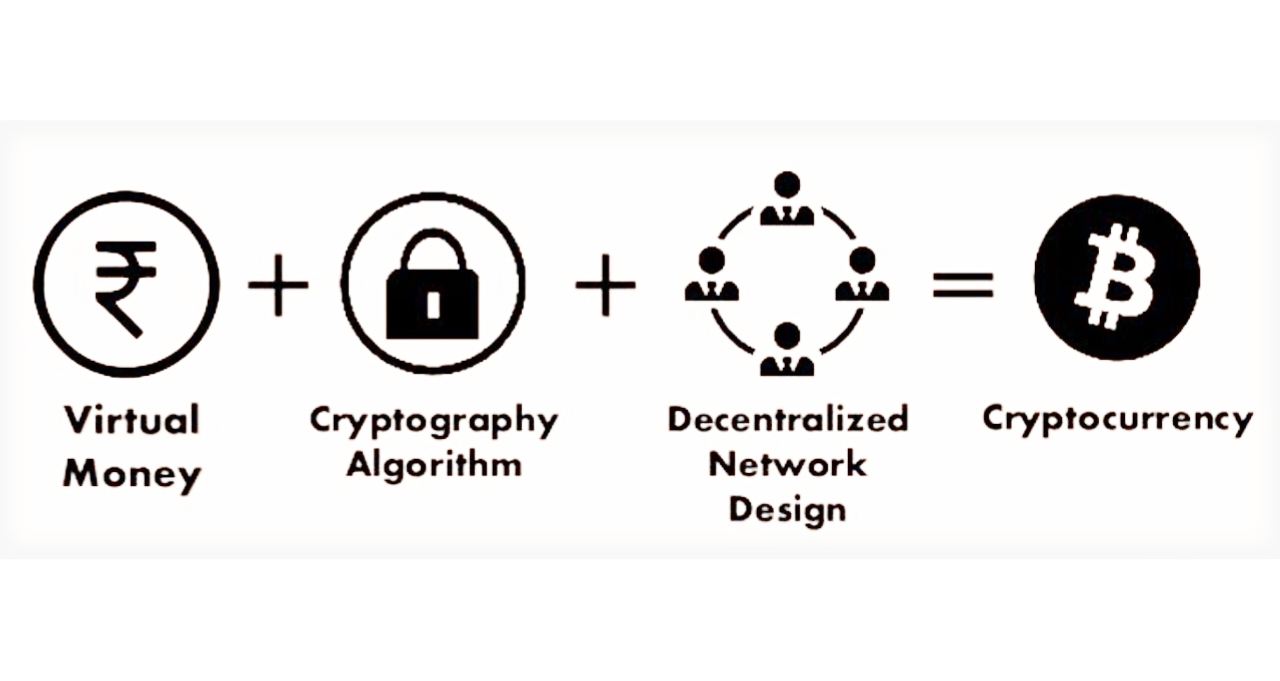

Cryptocurrency is a digital or virtual currency that uses cryptography for security and operates independently of a central bank. It is decentralized, meaning that it operates on a peer-to-peer network and is not controlled by any government or financial institution.

Cryptocurrencies use complex mathematical algorithms to secure transactions and to control the creation of new units. Transactions are verified and recorded on a public ledger called a blockchain. This ledger is distributed among all users of the cryptocurrency network, ensuring transparency and preventing fraud.

The most well-known cryptocurrency is Bitcoin, but there are now thousands of different cryptocurrencies in circulation, each with its unique features and uses. Cryptocurrencies are often used for online transactions, but they can also be used for investment purposes or as a store of value.

Cryptocurrencies are typically created through a process called mining, where powerful computers solve complex mathematical equations to verify and record transactions on the blockchain. As a reward for their efforts, miners receive a certain amount of cryptocurrency, which they can then sell on the open market.

One of the defining characteristics of cryptocurrencies is their limited supply. Unlike traditional currencies that can be printed and circulated at will, most cryptocurrencies have a fixed or finite supply, which is controlled by the underlying algorithm. This means that cryptocurrencies are often seen as a hedge against inflation, as their supply cannot be artificially inflated.

In addition to Bitcoin, other popular cryptocurrencies include Ethereum, Litecoin, Ripple, and Bitcoin Cash. Each cryptocurrency has its unique strengths and weaknesses, and some are better suited for specific use cases than others.

Although cryptocurrencies offer many potential benefits, they are also subject to a range of risks and challenges. For example, their value can be highly volatile, and they can be vulnerable to hacking and other security threats. Governments and financial regulators are also grappling with how to regulate cryptocurrencies, which can be used for illegal activities such as money laundering and tax evasion.

Despite these challenges, cryptocurrencies continue to grow in popularity, with more and more individuals and businesses exploring their potential uses and applications.

Types Of Cryptocurrencies

There are several different types of cryptocurrencies, each with its own unique characteristics and features. Here are some of the most common types:

Bitcoin:

The first and most well-known cryptocurrency, created in 2009, uses a decentralized ledger called blockchain to record transactions.

Altcoins:

Any cryptocurrency other than Bitcoin is referred to as an altcoin, which includes Ethereum, Litecoin, Bitcoin Cash, and many others.

Stablecoins:

Cryptocurrencies that are pegged to a stable asset, such as the US dollar, to minimize price fluctuations are known as stablecoins. Tether and USD Coin are examples of stablecoins.

Utility Tokens:

Cryptocurrencies that are designed to be used within a specific ecosystem, such as for paying fees or accessing services, are called utility tokens. Examples include Binance Coin and Chainlink.

Security Tokens:

Cryptocurrencies that represent ownership of a real-world asset, such as stocks or real estate, are referred to as security tokens.

Privacy Coins:

Cryptocurrencies that are designed to provide increased privacy and anonymity to users, such as Monero and Zcash, are known as privacy coins.

NFTs:

Non-Fungible Tokens (NFTs) are unique digital assets that are stored on a blockchain, which can represent anything from artwork to in-game items.

Platform tokens:

These are cryptocurrencies that are used as fuel for decentralized platforms. For example, Ethereum is a decentralized platform that uses Ether as its fuel to power transactions and smart contracts.

Asset-backed cryptocurrencies:

These are cryptocurrencies that are backed by real-world assets, such as gold or real estate. These types of cryptocurrencies are designed to provide stability and are often used as a store of value.

Central Bank Digital Currencies (CBDCs):

These are digital versions of traditional fiat currencies, issued by central banks. Some countries, such as China and Sweden, have already developed and are testing CBDCs.

Forked cryptocurrencies:

These are cryptocurrencies that are created when a new version of an existing blockchain is created, resulting in a separate network and cryptocurrency. For example, Bitcoin Cash is a fork of Bitcoin.

Decentralized Autonomous Organization (DAO) tokens:

These are cryptocurrencies that represent ownership in a decentralized autonomous organization, which is an organization that operates based on rules encoded in smart contracts.

Proof-of-Stake (PoS) coins:

These are cryptocurrencies that use a different consensus mechanism than Bitcoin's proof-of-work (PoW) consensus. Instead, PoS coins use a stake-based consensus, where validators are selected based on the amount of cryptocurrency they hold and are willing to "stake" or lock up as collateral.

Interoperable cryptocurrencies:

These are cryptocurrencies that are designed to facilitate interoperability between different blockchains, allowing for seamless transfer of assets between different networks. Examples of interoperable cryptocurrencies include Polkadot and Cosmos.

Governance tokens:

These are cryptocurrencies that are used to enable holders to participate in the governance of a decentralized network. Governance tokens allow holders to vote on network upgrades, changes to the protocol, and other decisions related to the operation of the network. Examples of governance tokens include MakerDAO's MKR and Compound's COMP.

Energy-efficient cryptocurrencies:

These are cryptocurrencies that use a different consensus mechanism than proof-of-work (PoW) to reduce their energy consumption. For example, proof-of-stake (PoS) and delegated proof-of-stake (DPoS) are consensus mechanisms that require significantly less energy than PoW. Examples of energy-efficient cryptocurrencies include Cardano and EOS.

Social media-based cryptocurrencies:

These are cryptocurrencies that are integrated with social media platforms, allowing users to earn cryptocurrency for their contributions to the platform. Examples of social media-based cryptocurrencies include Steem and Hive.

Centralized cryptocurrencies:

These are cryptocurrencies that are managed by a centralized entity, rather than being decentralized like Bitcoin. Examples of centralized cryptocurrencies include Ripple's XRP and Tether.

Gaming cryptocurrencies:

These are cryptocurrencies that are designed to be used within gaming ecosystems, allowing users to purchase in-game items and services, as well as to earn rewards for playing games. Examples of gaming cryptocurrencies include Enjin Coin and Chiliz.

Privacy-focused cryptocurrencies:

These are cryptocurrencies that are designed to provide increased privacy and anonymity to users, with a focus on protecting their identity and transaction history. Examples of privacy-focused cryptocurrencies include Dash and Verge.

Cross-chain cryptocurrencies:

These are cryptocurrencies that are designed to allow for interoperability between different blockchains, enabling users to exchange assets across different networks. Examples of cross-chain cryptocurrencies include Ren and Wanchain.

Environmental-friendly cryptocurrencies:

These are cryptocurrencies that are designed to minimize their environmental impact by using renewable energy sources or implementing carbon offsetting programs. Examples of environmental-friendly cryptocurrencies include Cardano and Energy Web Token.

Donation-based cryptocurrencies:

These are cryptocurrencies that are designed to facilitate donations to charitable causes, allowing users to donate to various organizations using cryptocurrency. Examples of donation-based cryptocurrencies include Pinkcoin and Giveth

What is a Bitcoin Node?

Bitcoin nodes are computers that are connected to the Bitcoin network and run Bitcoin software that allows them to validate transactions and blocks, and relay them to other nodes on the network.

Nodes play a crucial role in the Bitcoin network as they help to maintain the integrity and security of the network. When a user initiates a Bitcoin transaction, it is broadcast to the network of nodes, which then verify the transaction and confirm that it meets the network's rules and requirements. Nodes also work together to validate new blocks of transactions that are added to the blockchain. Once a block is validated, nodes relay it to other nodes on the network, allowing it to be added to the blockchain.

There are different types of nodes on the Bitcoin network, including:

Full nodes:

These nodes download and store a full copy of the entire Bitcoin blockchain. They validate and relay all transactions and blocks on the network, and are critical to maintaining the integrity and security of the network.

Lightweight nodes:

These nodes don't store a full copy of the blockchain, but rather rely on full nodes to validate transactions and blocks. They are used by most individual users who don't need to validate transactions themselves.

Mining nodes:

These nodes are used by Bitcoin miners to participate in the process of adding new blocks to the blockchain. They perform the resource-intensive task of solving complex mathematical equations to validate new blocks and earn Bitcoin rewards.

In summary, Bitcoin nodes are computers that help to maintain the integrity and security of the Bitcoin network by validating transactions and blocks, and relaying them to other nodes on the network

Here are some additional details about Bitcoin nodes:

Nodes are decentralized:

There is no central authority or organization that controls Bitcoin nodes. Anyone can download the necessary software and become a node, making the network completely decentralized and transparent.

Nodes can choose which software to run:

There are different implementations of Bitcoin software available, and nodes can choose which software they want to run. This helps to prevent a single point of failure and ensures that the network remains decentralized.

Nodes can be used to measure network health:

By monitoring the number and distribution of nodes on the network, researchers and developers can get a sense of the overall health and security of the Bitcoin network.

Running a node requires some technical knowledge:

While anyone can become a Bitcoin node, running a node requires some technical knowledge and the ability to maintain a computer and internet connection. However, there are resources available to help guide users through the process.

Nodes can be incentivized:

While running a node is not inherently profitable, there are some initiatives underway to incentivize users to run nodes by offering rewards for participating in the network. For example, some projects offer incentives in the form of tokens or cryptocurrency for running a node.

Overall, Bitcoin nodes are a crucial component of the Bitcoin network, helping to maintain the integrity and security of the network by validating transactions and blocks and relaying them to other nodes on the network. By participating in the network, nodes help to ensure that the Bitcoin network remains decentralized, transparent, and secure